On June 23, 2021, the Oneida Business Committee will approve a change to the American Rescue Plan Act (ARPA) Fiscal Recovery Funds spending plan.

A one-time General Welfare payment of $3,000 will be issued to all eligible enrolled Oneida. You must be at least 18 by December 31, 2021 to be eligible for the payment. Applications will be available on July 1, 2021 with payment expected to be made by the end of September 2021. A future update will identify where applications can be obtained.

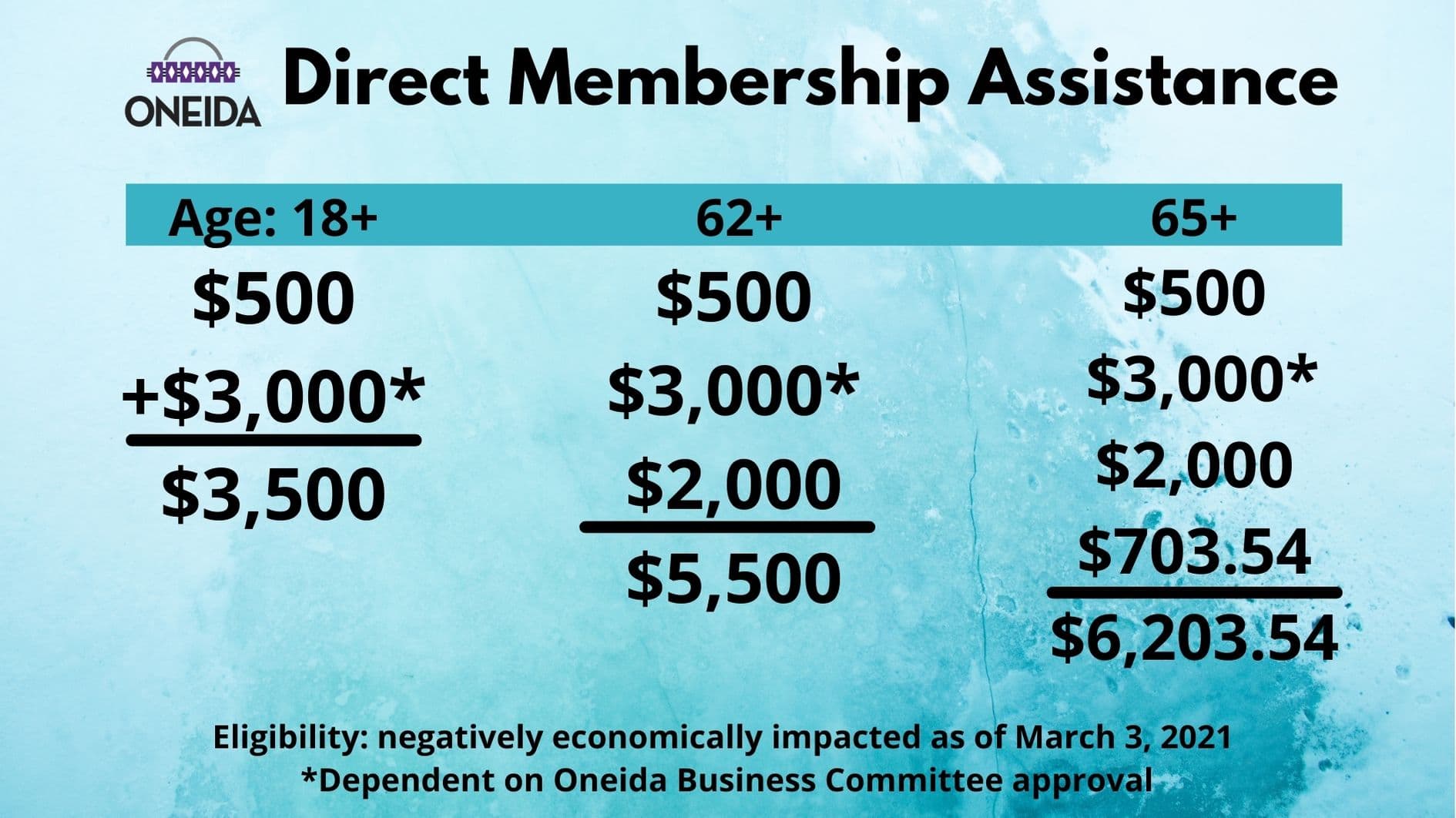

In addition, Tribal members will also receive the following payments;

All the payments are expected to be issued by end of September 2021 and will require applications. Applications for the General Welfare payments will be available beginning July 1, 2021. Applications for the Elder Per Capita payment have already been issued. If you have not received yours, please contact the Trust Enrollment Department enrollments@oneidanation.org or call 800-571-9902.

Some questions you may have about these payments

What is General Welfare Exclusion GWE)?

On September 26, 2014, President Obama signed into law the Tribal General Welfare Exclusion Act (“Act”) that would exclude from taxable income certain general welfare payments to the members of Indian tribes receiving certain and limited financial assistance from their tribe. The Act declares tribal government benefits to individual tribal members may qualify for exclusion from taxable income only if the benefits meet the guidelines of the General Welfare Exclusion Act.

What is the ARPA?

American Rescue Plan Act (ARPA) signed by President Biden. This act created the Fiscal Recovery Funds that were specifically set aside for Tribes to help turn the tide on the pandemic, address its economic fallout, and lay the foundation for a strong and equitable recovery.

Is the FRF (Fiscal Recovery Fund) another fund?

The Fiscal Recovery Fund was created under the American Rescue Plan Act that set aside $20 billion specifically for Tribes. This funding is being issued to Tribes by the U.S. Department of the Treasury based upon a formula created in consultation with Tribes.

Will this GWE payments affect my social security, disability or my supplemental social security?

No, this is a special payment not categorized as income, it is a general welfare exclusion.

Will I get a 1099 next year on these funds for my taxes?

No, this is not taxable or reportable income.

Will we get a per capita payment this year?

The Nation will be issuing General Welfare payments instead of Per Capita payments this year, except for the Elder 65 payment of $703.54.

I have applied for financial assistance for fuel/rent/food that is based upon my income, does this affect my applications?

No, this is not reportable income, it is General Welfare Exclusion payment (GWE).

How does this affect my unemployment?

There should be no impact on your unemployment; this is not income it is general welfare assistance and is not reportable or taxable.

Will I be eligible for any further stimulus payments administered by the federal government as I have in the past?

If you have received the federal stimulus payments based upon your previous year tax returns, you may also be eligible again, you will have to ask your tax preparation individual that question.

What’s the difference between the annual per capita payment and the allocation of funds to individual tribal members pursuant to the Oneida General Welfare Law?

Per capita payments: The Indian Gaming Regulatory Act (IGRA) requires net revenues from gaming may be used for specific purposes such as a per capita payment. The Oneida Nation complies with IGRA when distributing per capita payments from the gaming revenues to its membership. Per capita distributions are taxed as gross income to the recipient.

Payments pursuant to a general welfare exclusion law: The GWE or General Welfare Exclusion payments applies to payments to tribal members receiving certain and limited financial assistance from their tribe. The Act declares tribal government benefits to individual tribal members may qualify for exclusion from taxable income only if the benefits meet the guidelines therein. The Oneida Nation, through passage of the General Welfare Law, provides and maximizes financial assistance to tribal members in need which are not taxable to the member in accordance with Oneida Nation law, federal law, and through guidance from IRS procedures thereby expanding the impact of the assistance payments made to the member by the Nation.